virginia estimated tax payments 2021 forms

VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS FOR ESTATES TRUSTS AND UNIFIED NONRESIDENTS Form 770ES Vouchers and Instructions. Please enter your payment details below.

California Tax Forms H R Block

Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

. Visit our website at wwwtaxvirginiagov for information on. Click IAT Notice to review the details. Print This Form More about the Virginia Form 770ES Corporate Income Tax Voucher TY 2021 We last updated the Virginia Estimated Income Tax Payment Vouchers For Estates Trusts and Unified Nonresidents in February 2022 so this is the latest version of Form 770ES fully updated for tax year 2021.

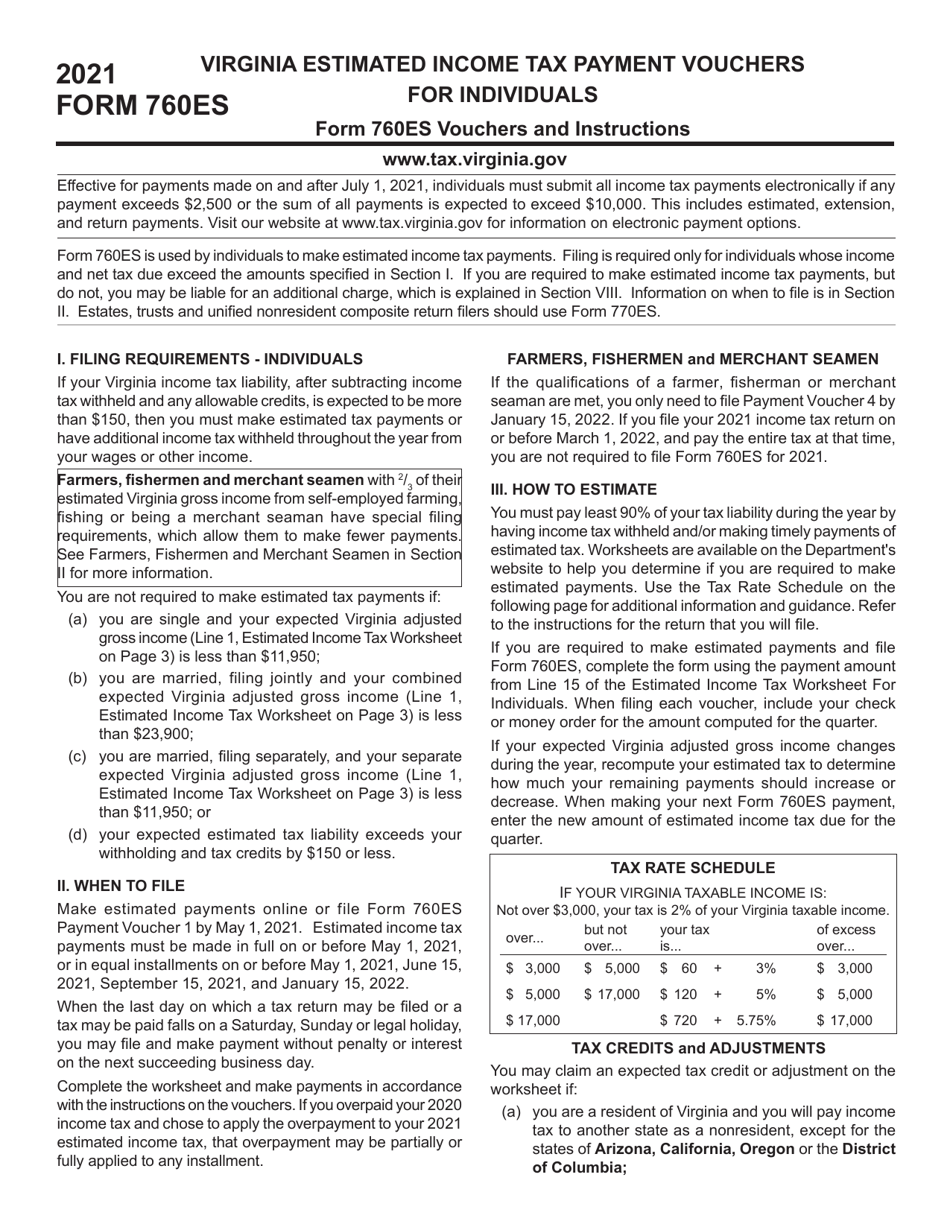

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Download or print the 2021 Virginia Form 760ES VA Estimated Income Tax Payment Vouchers and Instructions for Individuals for FREE from the Virginia Department of Taxation. Payment Please enter your payment details below.

This includes estimated extension and return payments. Forms Virginia Tax 760ES 2019 Form Tax Year Description Filing Options. Tax return you are required to make estimated tax payments using this form.

If you are not a calendar year taxpayer you should see the instructions to determine the due dates of Estimated tax payments should be mailed by the due date to. At present Virginia TAX does not support International ACH Transactions IAT. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Effective for payments made on and after July 1 2021 Pass-Through Entities must submit all unified nonresident income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. Did you owe Virginia state tax this year. 770ES 770ES For Period Filing Basis Calendar Fiscal For Taxable Year Estate Trust Form 765 Unified Nonresident Account Number 32- FEIN F-001 Demographics Name of Estate Trust or Unified Filer Name and Title of Fiduciary or Unified Filer Mailing Address City State ZIP Change of Address Payment Please enter your payment details below.

In January 2022 so this is the latest version of Form IT210 fully updated for tax year 2021. Form 760IP - Page 2 Tentative Tax Computation Worksheet 7RWDO 9LUJLQLD LQFRPH WD ZH HSHFW WR RZH 3DPHQWV DQG FUHGLWV a Virginia income tax withheld 2a b Virginia estimated tax payments 2b c Overpayment credit from previous taxable year 2c 7RWDO DGG LQHV D E DQG F. Virginia estimated payment vouchers for 2021- have not seen this before is this new for 2020 tax year.

The third round of Economic Impact Payments including the plus-up payments were advance payments of the 2021 Recovery Rebate Credit claimed on a 2021 tax return. However you may pay more than the minimum if you wish. Give Form W-4 to your employer.

TurboTax will automatically include four quarterly vouchers with your printout if you didnt withhold or pay enough tax this year. Form 770ES is used to make estimated income tax payments. 1546001745 At present Virginia TAX does not support International ACH Transactions IAT.

Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May. You can download or print current or past-year PDFs of Form IT-141ES directly from TaxFormFinder. Form 770ES is used to make estimated income tax payments.

State Tax Department Tax Account Administration Division - EST PO. It was issued starting in March 2021 and continued through December 2021. 76 rows Virginia Estimated Income Tax Payment Vouchers and Instructions for Individuals.

Individuals should review the information below to determine their eligibility to claim a Recovery Rebate. Enter your Virginia account number the ending month and year for the entire taxable year calendar fiscal or short taxable year for which the estimated payment is made not the ending date for the quarter the estimated payment is made. So this is the latest version of Form 760ES fully updated for tax year 2021.

See Tax Bulletin 22-1 for more information. Use these vouchers only if you have an approved waiver. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number.

Please enter your payment details below. Download or print the 2021 Virginia Form 500ES 500ES - Forms and Instructions for Declaration of Estimated Income Tax for FREE from the Virginia Department of Taxation. Enclose this form with Form 760 763 760PY or 770.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Virginia government. Be sure to post your payment in the payment table. More about the Virginia Form 760C Individual Income Tax Estimated TY 2021 If you failed to pay or underpaid your estimated taxes for the past tax year you must file form 760C to calculate any interest or penalties due with your income tax return.

Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. If the ending month for the taxable year of the corporation is March 2021 enter 03 21. February 19 2021 622 PM.

2022 Form 760ES Estimated Income Tax Payment Vouchers for Individuals. Print This Form We last updated the Fiduciary Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form IT-141ES fully updated for tax year 2021. Please note a 35 fee may be.

You can print other West Virginia tax forms here. Please note a 35 fee may be. File Form 770ES Payment Voucher 1 by May 1 2021.

More about the Virginia Form 760ES Estimated We last updated Virginia Form 760ES in January 2022 from the Virginia Department of Taxation. 760ES 2021 Virginia Estimated Income Tax Payment Vouchers and Instructions for Individuals File Online. You can print other west virginia tax forms here.

This form is for income earned in tax year 2021 with tax returns due in April 2022. This includes estimated extension and return payments. DIAGRAM in Pictures Database 2004 Mazda 3 Wiring Diagram.

Download This Form Print This Form More about the Virginia Form 760ES-2019 Individual Income Tax Estimated TY 2021 We last updated the 760ES - VA Estimated Income Tax Payment Vouchers and Instructions for Individuals in February 2021 so this is the latest version of Form 760ES-2019 fully updated for tax year 2021. Virginia Estimated Tax Payments 2021 Forms. Pay bills or set up a payment plan for all individual and business taxes.

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Tax Information Arizona State Retirement System

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

What Happens If You Miss A Quarterly Estimated Tax Payment

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

Washington Dc Tax Forms And Instructions For 2021 Form D 40

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

How To Read Your 1099 Robinhood

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Form 760es Download Fillable Pdf Or Fill Online Virginia Estimated Income Tax Payment Vouchers For Individuals 2021 Virginia Templateroller

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

1099 G 1099 Ints Now Available Virginia Tax